(Name of Registrant as Specified in its Charter)

TIMOTHY PLAN

--------------------------------------------------------------------------------------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

NOT APPLICABLE

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | |||

| Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: | |

| [ ] | |||

| Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: | |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: |

iv

Proxy Statement

April 14, 2015

Important Voting Information Inside

The Timothy Plan Defensive Strategies Fund

A Series of the Timothy Plan

Please vote immediately!

You can vote through the internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

1

Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

Toll Free 800-846-7526

SPECIAL MEETING OF THE SHAREHOLDERS OF

The Timothy Plan Defensive Strategies Fund

Important Voting Information Inside

TABLE OF CONTENTS

| ||||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

| ||||

2

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

of the

SHAREHOLDERS OF THE

TIMOTHY PLAN DEFENSIVE STRATEGIES FUND

1055 Maitland Center Commons

Maitland, FL 32751

Toll Free 800-846-7526

The Board of Trustees (the “Board”) of the Timothy Plan (the “Trust”) has voted to callis holding a special meeting of allthe shareholders of the Timothy Plan Defensive Strategies Fund (the “Fund”“Special Meeting”) on Monday, December 21, 2020 at 2:30 p.m., in order to seek shareholder approval of the proposals set forth below.Eastern Time. The Special Meeting will be held at the offices of Gemini Fund Services, LLC. (“Gemini”)the Trust’s Investment Adviser, Timothy Partners, Ltd., located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, at 10:00 a.m.1055 Maitland Center Commons Blvd., Eastern Time, on Wednesday, May 13, 2015. Gemini serves as Administrator to the Trust. If you expect to attend the Special Meeting in person, please call the Trust at 1-800-662-0201 to inform them of your intention. This proxy was first mailed to eligible shareholders on or about April 13, 2015.Maitland, FL 32751.

The Trust is a Delaware business trust, registered with the Securities and Exchange Commission (“SEC”) and operating as an open-end management investment company. The Trust has authorized the division of its shares into various series (“funds”) and currently offers shares of thirteeneighteen funds to the public. The Trust further has authorized the division of its shares into various classes, each with different sales charges and/or ongoing fees.

The Timothy Plan Defensive Strategies Fund (the “Fund”), which is the subject of this Special Meeting, offers Class A shares,Shares, which are sold to the public with a front-end sales charge, Class C Shares,shares, which are sold to the public and have no sales charges, but do charge an ongoing distribution (i.e., 12b-1) fee, and Institutional Class Shares, which are sold withoutwith a contingent deferred sales charge orof 1% for the first year and an ongoing distribution and servicing (12b-1) fee.

This Special Meeting is being held for all Fund shareholders, without regard fee of 1.00%, and Class I shares, which do not have sales charges or ongoing 12b-1 fees, but are restricted as to share class.purchasers.

The Meeting is being held so that shareholders can vote on the following proposals:

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

3

You may votetwo matters to be considered at the Special Meeting if youwill be:

| 1. | Approval by the Fund’s shareholders of a new investment sub-advisory agreement with Chilton Capital Partners, LLC (“Chilton”) to manage the Real Estate Investment Trust (“REIT”) Allocation of the Fund’s portfolio. |

| 2. | Approval by the Fund’s shareholders of a new investment sub-advisory agreement with Barrow, Hanley, Mewhinney & Strauss, LLC (“BHMS”) to manage the Fixed Income Allocation of the Fund’s portfolio. |

Fund shareholders are being asked to approve Chilton as the record owner of any class of sharesSub-Adviser for the REIT portion of the Fund due to the pending resignation of the Fund’s current sub-adviser to the REIT allocation, Delaware Management Business Trust (“Delaware”). Delaware is resigning because they are closing their REIT investment operation. After full consideration, the Trust’s Board of Trustees decided to engage Chilton for this purpose and to seek shareholder ratification of its decision.

Fund shareholders are being asked to approve a new sub-investment advisory agreement with BHMS due to a pending change in ownership control of BHMS. BHMS is the current Sub-Adviser to the fixed income allocation of the Fund. As discussed in the proxy statement, BrightSphere Investment Group (“BrightSphere”), a publicly-held company traded on the New York Stock Exchange, currently owns 75.1% of the issued and outstanding ownership interests in BHMS. BrightSphere has agreed to sell all of that interest to Perpetual U.S. Holding Company Inc. (“Perpetual”)(the “Transaction”). The Transaction is scheduled to close on or about November 30, 2020. Details of the Transaction and its effects are discussed below. Assuming the Transaction closes as agreed, the sub-advisory agreements currently in effect will terminate on that date. In order to ensure that the Funds continue to receive high quality investment management services, The Funds’ Adviser, Timothy Partners, Ltd, recommended to the Trust’s Board of Trustees that BHMS be re-engaged. After full consideration, the Board decided to re-hire BHMS as sub-adviser to the Fund and to seek shareholder ratification of its decision.

Fund shareholders of record at the close of business on March 31, 2015.November 4, 2020 are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof. The Notice of Special Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about November 9, 2020.

The enclosed materials explain the proposal to be voted on at the special meeting in more detail. No matter how large or small your Fund holdings, your vote is extremely important. We appreciate your participation and prompt response in this matter. If you should have any questions regarding the proposal, or to quickly vote your shares, please call Okapi Partners LLC, your Fund’s proxy solicitor, toll-free at 888-785-6709. Thank you for your continued investment in the Fund.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on December 21, 2020. A copy of the Notice of Special Meeting and accompanying Proxy Statement are available at www.okapivote.com/TPChilton.

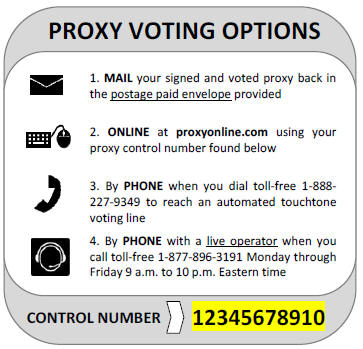

YOUR VOTE IS IMPORTANT

To assure your representation at the special meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You may also vote either by telephone or online by following the instructions on the enclosed proxy card. Whether or not you plan to attend the special meeting, please vote your shares; if you attend the Special Meeting,special meeting, you may revoke your proxy and vote your shares in person. Ifat the special meeting. Whichever method you expect to attendchoose, please read the Special Meeting, please call the Trust at 1-800-846-7526 to inform them.enclosed Proxy Statement carefully before you vote.

Your vote on eachthis proposal is very important. If you own Fund shares in more than one account of the Trust,Fund, you will receive a proxy statement and one proxy card for each of your accounts. You will need to fill out each proxy card in order to vote the shares you hold for each account. Proxies that are properly completed but received after the Special Meeting will be included for purposes of obtaining a quorum, but will not be counted towards the vote itself. However, if the Special Meeting is adjourned to a later date and the proxy is received before the next Meeting date, the vote will be counted

WhetherThe Fund is sensitive to the health and travel concerns the Fund’s shareholders may have and the protocols that federal, state and local governments may impose. Due to the difficulties arising from the coronavirus known as COVID-19, the date, time, location or means of conducting the special meeting may change. In the event of such a change, the Funds will announce alternative arrangements for the special meeting as promptly as practicable, which may include holding the special meeting by means of remote communication, among other steps, but the Funds may not deliver additional soliciting materials to shareholders or otherwise amend the Fund’s proxy materials. The Funds plan to announce these changes, if any, at www.OkapiVote.com/TPChiltonMeeting and encourages you to check this website prior to the special meeting if you plan to attend the Special Meeting, please fill in, date, sign and return your proxy card(s) in the enclosed postage paid envelope. You may also return your completed proxy card by faxing it to the Trust at 631-951-0573. attend.

PLEASE VOTE NOW TO HELP SAVE THE COST OF ADDITIONAL SOLICITATIONS.

As always, we thank you for your confidence and support.

By Order of the Board of Trustees, |

Arthur D. Ally |

Chairman |

April 14, 2015November 12, 2020

Proxy Statement

November 12, 2020

Important Voting Information Inside

The Timothy Plan Defensive Strategies Fund

A Series of the Timothy Plan

Please vote immediately!

You can vote through the internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

THE TIMOTHY PLAN

Special Meeting of the Shareholders of

the

Timothy Plan Defensive Strategies Fund

1055 Maitland Center Commons

Maitland, FL 32751

Toll Free 800-846-7526

4

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS

While we encourage you to carefully read the entire text of the Proxy Statement, for your convenience we have provided answers to some of the most frequently asked questions, and a brief summary of the proposals we are asking you to approve.

QUESTIONS AND ANSWERS

|

|

PROPOSAL 1: Updated Fundamental Investment LimitationsPROXY STATEMENT

|

|

|

|

|

|

|

|

|

|

|

Although the Fund currently has a fundamental limitation addressing each of these activities, the Fund’s current fundamental limitations are unnecessarily restricting the Fund’s ability to respond to changing circumstances and market opportunities. A comparison of the Fund’s existing and proposed fundamental limitations appears in this Proxy beginning on page 8.

|

|

|

|

|

|

5

TIMOTHY PLANDated November 12, 2020

SPECIAL MEETING OF SHAREHOLDERS OF

THE TIMOTHY PLAN DEFENSIVE STRATEGIES FUND

To Bebe Held on May 13, 2015December 21, 2020

Introduction

This Proxy Statement is being furnished in connection with the solicitation of proxies by theThe Board of Trustees (the “Board of Trustees”“Board”) of the Timothy Plan (the “Trust”) for use at the Special Meetinghas voted to call a special meeting of Shareholders (the “Meeting”)all shareholders of the Timothy Plan Defensive Strategies Fund (the “Fund”), in order to seek shareholder approval of two proposals relating to the Fund. The Special Meeting will be held on Monday, December 21, 2020 at 10:00 a.m.2:30 p.m., Eastern Time on May 13, 2015 at the offices of the Trust’s Administrator, Gemini Fund Services, Inc.Investment Adviser, Timothy Partners, Ltd., located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.1055 Maitland Center Commons Blvd., Maitland, FL 32751. If you expect to attend the Special Meeting in person, please call Okapi Partners, our proxy solicitor, toll-free at 888-785-6709 to inform them of your intention. This proxy was first mailed to eligible shareholders on or about November 9, 2020.

Proposals for Consideration

The two proposals to be considered at the Special Meeting will be:

| 1. | Approval by the Fund’s shareholders of a new investment sub-advisory agreement with Chilton Capital Partners, LLC (“Chilton”) to manage the Real Estate Investment Trust (“REIT”) Allocation of the Fund’s portfolio. |

| 2. | Approval by the Fund’s shareholders of a new investment sub-advisory agreement with Barrow, Hanley, Mewhinney & Strauss, LLC (“BHMS”) to manage the Fixed Income Allocation of the Fund’s portfolio. |

Eligibility to Vote

If you were the record owner of any adjournment thereof. The principal business addressshares of the Fund as of the close of business on November 4, 2020 (the “Record Date”), then you are eligible to vote at the Special Meeting. As of the Record Date, the Fund had a total of 3,197,262.888 shares issued and outstanding. Each full share counts as one vote, and fractional shares count as fractional votes.

Voting by Proxy

The simplest and quickest way for you to vote is to complete, sign, date and return the enclosed proxy card(s) in the postage paid envelope provided. The Board urges you to fill out and return your proxy card(s) even if you plan to attend the Special Meeting. Returning your proxy card(s) will not affect your right to attend the Special Meeting and vote.

The Board has named Ben Mollozzi, Esq. and James McGuire as proxies, and their names appear on your proxy card(s). By signing and returning your proxy card(s) to the Trust, you are appointing those persons to vote for you at the Special Meeting. If you fill in and return your proxy card(s) to the Trust in time to vote, one of the appointed proxies will vote your shares as you have directed on your proxy. If you sign and return your proxy card(s), but do not make specific choices, one of the appointed proxies will vote your shares in favor of all items relating to your proxy.

If an additional matter is presented for vote at the Special Meeting, one of the appointed proxies will vote in accordance with his/her best judgment. At the time this proxy statement was printed, the Board was not aware of any other matter that needed to be acted upon at the Special Meeting other than the two Proposals discussed in this proxy statement.

If you appoint a proxy by signing and returning your proxy card(s), you can revoke that appointment at any time before it is exercised. You can revoke your proxy by sending in another proxy with a later date, or by notifying the Trust’s Secretary, in writing, that you have revoked your proxy prior to the Special Meeting. The Trust’s Secretary is Mr. Joseph Boatwright and he may be reached at the following address: 1055 Maitland Center Commons, Maitland, FL 32751.

As described in more detail below, at

In addition to voting by mail, you may vote by telephone or through the Meeting, the Fund’s shareholders are being asked to consider the following proposals:Internet as follows:

| ||||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

| ||||

| TO VOTE BY TELEPHONE: | TO VOTE BY INTERNET: | TO VOTE BY MAIL | ||||||||

1 | Read the Proxy Statement and have the enclosed proxy card at hand | 1 | Read the Proxy Statement and have the enclosed proxy card at hand | 1 | Read the Proxy Statement and have the enclosed proxy card at hand | |||||

2 | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | 2 | Go to the website that appears on the enclosed proxy card and follow the simple instructions | 2 | Fill out the proxy card, sign it, and mail it to the address on the card. | |||||

Your proxy, if properly executed, duly returned and not revoked, will be voted in accordance with your directions onWe encourage you to vote by telephone or through the proxy. If you properly execute and return your proxy but do not provide instructions with respect to a proposal, your proxy will be voted forinternet using the control number that proposal. You may revoke a proxy at any time prior to the Meeting by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting in person. This Proxy Statement and proxy card were first mailed to shareholdersappears on or about April 13, 2015.

The Fund will pay the cost of preparing, printing and mailing the enclosed proxy card(s)card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

Voting in Person

If you attend the Special Meeting and certainwish to vote in person, you will be given one ballot for each of your accounts when you arrive. If you have already voted by proxy and wish to vote in person instead, you will be given an opportunity to do so during the Special Meeting. If you attend the Special Meeting, but your shares are held in the name of your broker, bank or other costs incurrednominee, you must bring with you a letter from that nominee stating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote.

Requirement of a Quorum

A quorum is the number of outstanding shares, as of the Record Date, that must be present in person or by the Fundproxy in connection with matters presented to the Meeting, including the fees and expenses of counsel toorder for the Trust and its Independent Trustees.

to hold a valid shareholder meeting. The Trust has retained AST Fund Solutions (“AST”) to solicit proxies for the Meeting. ASTcannot hold a valid shareholder meeting unless there is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting broker-dealer firms, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services.

In addition to solicitation through the mail, proxies may be solicited by representativesa quorum of shareholders. For this Special Meeting, 1,598,632.440 (50% + 1) eligible shares of the Fund without costmust be present, in person or by proxy, to constitute a quorum.

Under rules applicable to broker-dealers, if your broker holds your shares in its name, the Fund. Such solicitation may be by telephone, facsimile or otherwise. Itbroker is anticipated that broker-dealer firms, custodians, nominees, fiduciaries and other financial institutionsnot allowed to vote your shares unless it has received voting instructions from you. If your broker does not vote your shares because it has not received instructions from you, those shares will be requestedconsidered broker non-votes. Broker non-votes and abstentions count as present for purposes of establishing a quorum, and count as votes cast against the Proposals.

Required Votes to forward proxy materialsApprove the Proposal

The affirmative vote of a “majority” of the shares entitled to beneficial owners andvote of each Fund, as of the Record Date, is required in order to obtain approval forapprove the executionProposal. For purposes of proxies.

6

|

|

You are being asked to adopt a revised set of fundamental investment limitations that conform to the provisions ofapproving shareholder proposals, the Investment Company Act of 1940, as amended (the “1940 Act”), and positions defines a “majority” of the staffoutstanding voting securities of a fund as the lesser of (a) the vote of holders of at least 67% of the voting securities of the Fund present in person or by proxy, if more than 50% of such shares are present in person or by proxy; or (b) the vote of holders of more than 50% of the outstanding voting securities of the Fund.

Proxies that are properly completed but received after the Special Meeting will be included for purposes of obtaining a quorum, but will not be counted towards the vote itself. However, if the Special Meeting is adjourned to a later date and the proxy is received before the next Meeting date, the vote will be counted.

Adjournments

The appointed proxies may propose to adjourn the Special Meeting, either in order to solicit additional proxies or for other purposes. If there is a proposal to adjourn the Special Meeting, the affirmative vote of a majority of the shares present at the Special Meeting, in person or by proxy, is required to approve the adjournment.

Costs of The Shareholder Meeting And Proxy Solicitation

The Fund is paying the costs of the proxy relating to the Chilton proposal. BHMS is paying the costs of the proxy relating to the BHMS proposal. Certain persons associated with Timothy Partners, Ltd, Investment Adviser and Principal Underwriter to the Fund (“TPL”), or their designees, may be conducting proxy solicitations. TPL will not be charging the Fund for any costs

associated with such solicitations. TPL has engaged the services of Okapi Partners (“Okapi”) to manage and oversee the proxy solicitation. Okapi will be conducting the mailing and tabulation of proxies, will provide an internet voting portal, will interface with fund intermediaries, and will conduct any necessary solicitations. The estimated costs of the Special Meeting and proxy solicitation is approximately $25,626, $12,813 of which will be paid by BHMS, and the remainder by the Fund. If you have any questions or issues, you may call Mr. Terry Covert of TPL, at 800-846-7526.

Who To Call With Questions

If you have any questions regarding the Proxy Statement or to quickly vote your shares, please call Okapi Partners LLC toll-free at 888-785-6709. Also, at your request, the Trust will send you a free copy of its most recent audited annual report, dated September 30, 2019, and its most recent unaudited semi-annual report, dated March 31, 2020. Simply call the Trust at 800-846-7526 to request a copy of the report of your choice, and it will be sent to you within three (3) business days of receipt of your request.

PROPOSAL # 1. | APPROVAL OF A NEW SUB-INVESTMENT ADVISORY AGREEMENT CHILTON CAPITAL PARTNERS, LLC (“CHILTON”) ON BEHALF OF REIT ALLOCTION OF THE TIMOTHY PLAN DEFENSIVE STRATEGIES FUND |

Background

The Investment Adviser

Timothy Partners, Ltd. (“TPL”), 1055 Maitland Center Commons, Maitland, FL 32751, serves as investment adviser to the Fund under a written investment advisory agreement approved by the Board and separately ratified by the Fund’s shareholders. The investment advisory agreement with TPL has been in effect since the Fund’s inception in October, 2013.

TPL is a Florida limited partnership organized on December 6, 1993 and is registered with the Securities and Exchange Commission (the “SEC”(“SEC”). Under as an investment adviser. Mr. Arthur D. Ally is President of TPL and is responsible for the 1940 Act,day-to-day activities of TPL. Covenant Funds, Inc., a Florida corporation (“CFI”), is the Fundmanaging general partner of TPL. Mr. Ally also is requiredPresident, sole officer and 70% shareholder of CFI. Mr. Ally had over eighteen years’ experience in the investment industry prior to adopt certain “fundamental” investment policies that can be changed only by a shareholder vote. Because the Fund has been in operationfounding TPL, having worked for several years, manyPrudential Bache, Shearson Lehman Brothers and Investment Management & Research. In addition to his positions as President of its fundamental investment limitations reflect certain regulatory, business or industry conditions that are no longer in effect.

After conducting an analysisTPL and CFI, Mr. Ally also serves as President and Chairman of the Fund’s fundamental investment limitations, the Adviser has recommended to the Board that certain fundamental investment limitations be amended or eliminated in order to (i) clarify certain language; (ii) simplify certain fundamental investment limitations by omitting unnecessary language regarding non-fundamental exceptions or explanations; (iii) eliminate fundamental investment limitations that are no longer required under state securities laws, the 1940 Act or the positions of the staff of the SEC in interpreting the 1940 Act; and, (iv) provide additional flexibility to the Fund’s portfolio management process by permitting the Funds to engage in certain investment activities consistent with current law and to better respond to changing markets, new investment opportunities and future changes to applicable law. It is possible and even likely that, as the financial markets continue to evolve over time, the 1940 Act and other applicable law may be amended to address changed circumstances and new investment opportunities. It is also possible that the 1940 Act and other law could change for other reasons. Because many of the existing fundamental investment limitations are more restrictive than the law requires, their presence unnecessarily limits the Fund’s investment activities without a meaningful benefit to shareholders. The new updated fundamental investment limitations will provide the Board of Trustees with broader discretion to determineof the Fund’s investment policiesTrust. Mr. Ally does not receive any compensation for his services to the full extent permittedTrust as an officer or Trustee of the Trust, but he does receive compensation from TPL as a result of his ownership interest in TPL and service as an officer and director of TPL.

For its services to the Fund, TPL receives a fee, calculated daily and paid monthly, equal to an annual rate of 0.60% of the average daily net assets of the Fund. The Advisory Agreement with TPL was last approved by the 1940 Act and other applicable law as they may be amended from time to time, or new rules, interpretations and exemptions implemented by the SEC or other agencies without seeking costly and time-consuming shareholder approval.Board at a meeting held on February 14, 2020.

The Board has reviewedInvestment Management Structure

TPL serves as the proposed new updated fundamental investment limitations ofadviser to the Fund as set forth in Proposals 1a-g and has concluded thatis responsible for the Proposals are in the best interestsoverall management and supervision of the Fund and its operations. However, the day-to-day selection of securities for the Fund and the provision of a continuing and cohesive fund investment strategy is generally handled by one or more sub-advisers (“Sub-Advisers”).

One of TPL’s principal responsibilities as investment adviser is to select and recommend suitable firms to offer day-to-day investment management services to the funds as sub-advisers. These sub-advisory firms are paid for their services to the particular fund by TPL out of the fees paid to TPL by the applicable fund.

The Fund currently engages a sub-adviser to manage the REIT allocation of the Fund’s investment portfolio. Delaware Management Business Trust (“Delaware”) has been the Sub-Adviser to the Fund since its inception in October 2013. The Delaware Sub-Advisory Agreement was last approved by shareholders on February 14, 2020. Under the terms of the Delaware sub-advisory agreement, Delaware manages the day-to-day investment and has unanimouslyreinvestment of the Fund’s REIT allocation and continuously reviews, supervises and administers the investment program of the Fund, all under the supervision of TPL and the Trust’s Board. Under the agreement, Delaware is not liable for any error of judgment or any loss unless the error or loss results from the gross negligence, bad faith or willful malfeasance in the performance of its duties under the agreement. The agreement may be terminated without penalty by any party upon 60 days written notice.

In August, 2020, Delaware announced its intention to resign as Sub-Adviser to the Fund, effective upon the approval of its replacement. Delaware decided to resign because it was in the process of closing its REIT investment operation. At a Special Meeting of the Board held on September 28, 2020, the Board formally considered the engagement of Chilton to replace Delaware, and after full consideration, approved the Proposals, subjectengagement of Chilton for the REIT allocation of the Fund and directed Trust management to call a shareholders meeting of the Fund to seek shareholder approval of the Fund’s shareholders.decision.

YouThe proposed sub-advisory agreement with Chilton is identical in all material respects to the current Delaware agreement. A copy of the proposed Sub-Advisory Agreement is attached to this proxy as Exhibit B.

Fees and Expenses

Fees paid to Chilton under the proposed sub-advisory agreement are almost identical to the fees currently being askedpaid to vote on each Proposal separatelyDelaware under its agreement. It is important to note that fees paid to sub-advisers are paid by TPL, out if its fees, and not by the Fund. Accordingly, even though the sub-advisory fees charged by the two firms are slightly different, there is no effect whatsoever on the enclosed proxy card. IfFund and its fee structure.

For its services rendered to the Fund, TPL will pay to Investment Chilton a Proposal is not approved by shareholders, the Fund’s current limitation will remain unchanged and the Board may consider other courses of action.

7

Proposal No. 1a

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO BORROWING MONEY

AND ISSUING SENIOR SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding borrowing money and the issuance of senior securities. The Funds’ existing fundamental investment limitation with respect to borrowing money and issuing senior securities will be separated into two fundamental limitations as follows:

Proposal No. 1a(i)

BORROWING MONEY

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding borrowing money. The 1940 Act generally permits a fund to borrow money infee at an amountannual rate equal to or less than 33 1/3% of its total assets (including the amount borrowed) from banks, or an amount equal to or less than 5% of its total assets for temporary purposes from any unaffiliated lender. Mutual funds typically borrow money to cover short-term cash needs (such as to cover large and unexpected redemptions) without having to sell portfolio securities at a time when a sale would be disadvantageous for investment reasons. The Fund’s existing investment limitation is more prohibitive than the requirements of the 1940 Act and has the effect of unnecessarily limiting the Fund’s borrowing practices.

Listed below is a description0.42% of the Fund’s current and proposed fundamental limitation with respectaverage daily assets allocated to borrowing money and the implicationsREIT sleeve of the Proposal:Defensive Fund’s investment portfolio (“Allocated Assets”) up to $10 million, 0.39% for the next $10 million in Allocated Assets, 0.35% for the next $30 million in Allocated Assets, and 0.30% of Allocated Assets over $50 million.

The following chart shows the effect on Fund expenses of the changeover to Chilton as sub-adviser to the Fund:

Class A | Current | After | ||||||||

Management Fee | 0.60% | 0.60% | ||||||||

Distribution/Service (12b-1) fees | 0.25% | 0.25% | ||||||||

Other Expenses | 0.60% | 0.60% | ||||||||

Fees and Expenses of Acquired Funds | 0.01% | 0.01% | ||||||||

Total Annual Fund Operating Expenses | 1.46% | 1.46% | ||||||||

Class C | Current | After | ||||||||

Management Fee | 0.60% | 0.60% | ||||||||

Distribution/Service (12b-1) fees | 1.00% | 1.00% | ||||||||

Other Expenses | 0.60% | 0.60% | ||||||||

Fees and Expenses of Acquired Funds | 0.01% | 0.01% | ||||||||

Total Annual Fund Operating Expenses | 2.21% | 2.21% | ||||||||

The fees described above shall be computed daily based upon the net asset value of the Allocated Assets as determined by a valuation made in accordance with the Trust’s procedures for calculating the Defensive Fund’s net asset value as described in the Trust’s currently effective Prospectus and/or Statement of Additional Information.

Information About Chilton Capital Management, LLC

Chilton Capital Management, LLC (“Chilton”), 1177 West Loop South, Suite 1750, Houston, TX, was founded in 1996 as a registered investment advisor, and has provided investment advisory services to mutual funds, institutional investors and individual investors since that time. Chilton’s primary owners are Knapp Brothers, LLC (“Knapp Brothers”), a Texas limited liability company, and certain employees of Chilton. Knapp Brothers has a fifty-five percent (55%) direct beneficial ownership and certain employees of Chilton collectively have a forty-five percent (45%) beneficial ownership. The primary owners of Knapp Brothers are Messrs. David M. Underwood, Jr. and A. John Knapp, Jr. Chilton is managed and controlled under the direction of its Board of Managers, which is comprised of Mr. David M. Underwood, Jr., as Chairman, Mr. R. Randall Grace, Jr., Mr. John E. Robertson, Ms. Laura L. Genung, and Mr. Timothy J. Lootens (collectively, the “Board of Managers”).

Portfolio Managers

Chilton will utilize a team of investment professionals who are responsible for the day-to-day recommendations regarding the investment of the REIT allocation of the Fund’s portfolio.

Co portfoliomanagers Bruce G. Garrisonwith over 48 years of experience as a portfolio manager/analyst and Matthew R. Werner, with 14 years of experience as a portfolio manager/analyst, joined Chilton in 2011 to manage a REIT strategy. They brought $50M in assets from their prior firm. Total strategy assets under advisement are $510M as of 9/30/20.

Additional Information about Chilton

The following table presents information relating to the persons responsible for managing Fund assets, the number and types of other accounts managed by such persons, and how such persons are compensated for managing such accounts. The information is current as of September 30, 2020.

|

| |||

|

| |||

|

| |||

|

|

The Board of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1a (i)

8

Proposal No. 1a(ii)

ISSUING SENIOR SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the issuance of senior securities. A senior security is generally any security that gives its holder a priority claim on a mutual fund’s assets or on dividends paid by a fund. A number of different investment instruments and strategies – forward and futures contracts, repurchase agreements, short selling, options writing and certain derivatives – may involve the issuance of a senior security. The 1940 Act prohibits funds from issuing or selling senior securities, but the SEC has taken the position that instruments and strategies that otherwise might be considered to involve senior securities will not be considered senior securities if funds use certain protective techniques. These techniques include holding an offsetting position or segregating liquid assets in an amount sufficient to meet the fund’s obligations under the instrument or strategy. The Fund’s existing investment limitation is more prohibitive than the requirements of the 1940 Act and has the effect of unnecessarily restricting the Fund’s ability to issue senior securities.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to issuing senior securities and the implications of the Proposal:

|

| |

|

| |

|

| |

|

The Board of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1a(ii).

9

Proposal No. 1b

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO PURCHASING AND SELLING COMMODITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the purchase and sale of commodities. Commodities include physical commodities such as grains, metals and foods. Commodities may also include financial derivative or commodities contracts, such as futures contracts, and options thereon, including currency, stock index, or interest rate futures. The 1940 Act and the Internal Revenue Code contain provisions that, as a practical matter, limit how much a mutual fund can invest in commodities; however, the Fund’s existing limitation is more prohibitive than the requirements of the 1940 Act and the Internal Revenue Code and has the effect of unnecessarily limiting the Fund’s commodity investments.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to purchasing and selling commodities and the implications of the Proposal:

|

| |||

| ||||

|

| |||

|

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1b.

10

Proposal No. 1c.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO CONCENTRATING INVESTMENTS IN A PARTICULAR INDUSTRY OR GROUP OF INDUSTRIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding concentrating investments in a particular industry or group of industries. The SEC staff has taken the position that a fund concentrates its investments if it invests more than 25% of its assets in any particular industry or group of industries. For this purpose, investments do not include certain items such as cash, U.S. government securities, securities of other investment companies and certain tax-exempt securities.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to concentrating investments and the implications of the Proposal:

|

| |

| ||

|

| |

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1c.

11

Proposal No. 1d

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO INVESTING IN REAL ESTATE

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the purchase and sale of real estate. Since the 1940 Act does not prohibit funds from investing in real estate, either directly or indirectly, the Fund’s investment limitation unnecessarily limits the Fund’s investments in real estate.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to real estate and the implications of the Proposal:

|

| |

| ||

|

| |

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1d.

12

Proposal No. 1e.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO UNDERWRITING SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy with respect to engaging in the business of underwriting securities issued by other persons. Under the federal securities laws, a person or company generally is considered an underwriter if it participates in the public distribution of securities of other issuers, usually by purchasing the securities from the issuer with the intention of re-selling the securities to the public.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to underwriting and the implications of the Proposal:

|

| |

| ||

|

| |

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1e.

13

Proposal No. 1f.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO LOANS

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding making loans to other persons. As a general matter, the 1940 Act permits funds to lend their portfolio securities, subject to certain restrictions and guidelines developed by the SEC staff. The following guidelines for lending portfolio securities have been developed by SEC staff:

|

|

|

|

The Fund’s existing limitation is more restrictive than the requirements of the 1940 Act and has the effect of unnecessarily limiting the Fund’s lending practices.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to loans and the implications of the Proposal:

|

| |

| ||

|

| |

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1f.

14

Proposal No. 1g.

TO ELIMINATE FUNDAMENTAL INVESTMENT LIMITATIONS NOT REQUIRED BY LAW

The fundamental investment limitations that shareholders are being asked to adopt include only those policies that are required by the 1940 Act. A number of the Fund’s fundamental investment limitations were adopted many years ago in order to satisfy state regulatory requirements. In 1996, Congress preempted the states from imposing such requirements. Many of these limitations relate to instruments or strategies that the Fund does not use today and does not expect to use in the future. Even after the unnecessary policies are eliminated, the Fund will still be limited with regards to many of the activities covered by the policies. For example, federal law limits the degree to which the Fund may invest in illiquid securities, purchase securities on margin or sell securities short.

Listed below is a description of the Fund’s current fundamental limitations that are no longer required and the implications of the Proposal:

|

|

|

| |||

|

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1g.

15

|

|

The proxy holders have no present intention of bringing any other matter before the Meeting other than the matters described herein or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on March 31, 2015 (the “Record Date”) as the record date for determining shareholders of the Fund entitled to notice of and to vote at the Meeting or any adjournment thereof. As of the Record Date, there were 6,184,490.947 outstanding shares of beneficial interest of the Fund. Each share is entitled to one vote, with proportionate voting for fractional shares.

5% Shareholders. As of the Record Date, the following shareholders owned of record more than 5% of the outstanding shares of the Fund. Accounts with an asterisk may be deemed to control the Fund by virtue of owning more than 25% of the outstanding shares. No other person owned of record and, according to information available to the Trust, no other person owned beneficially, 5% or more of the outstanding shares of the Fund on the Record Date.

| Number of Other Accounts Managed And Assets by Account Type | Number of Accounts and Assets for Which Advisory Fee is Performance- Based | |||||||||||||

| ||||||||||||||

| ||||||||||||||

| Registered Investment Companies ($mils) | ||||||||||||||

| Other Pooled Investment Vehicles ($mils) | Other Accounts ($mils) | Registered Investment Companies ($mils) | Other Pooled Investment Vehicles ($mils) | Other Accounts ($mils) | ||||||||||

| ||||||||||||||

| 1 ($34.0) | ||||||||||||||

| ||||||||||||||

| 0 ($0) | ||||||||||||||

| ||||||||||||||

| 113 ($370M) | ||||||||||||||

| N/A | N/A | |||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

In addition to base salary, all portfolio managers and analysts share in a bonus pool that is distributed semi-annually. The amount of bonus compensation is based on quantitative and qualitative factors. Analysts and portfolio managers are rated on their value added to the team-oriented investment process. Compensation is not tied to a published or private benchmark. It is important to understand that contributions to the overall investment process may include not recommending securities in an analyst’s sector if there are no compelling opportunities among the industries covered by that analyst. Many of our key employees, including all portfolio managers and the majority of our analysts, have economic ownership in Chilton.

16

Quorum. A quorumThe compensation of portfolio managers is not directly tied to growth in assets and portfolio managers are not compensated for bringing in new business. Of course, growth in assets from the numberappreciation of shares legally requiredexisting assets and/or growth in new assets will increase revenues and profit. The consistent, long-term growth in assets at any investment firm is to be at a meeting in order to conduct business, which is more than 50%great extent, dependent upon the success of the outstanding sharesportfolio management team. The compensation of the portfolio management team at Chilton will increase over time, if and when assets continue to grow.

As of September 30, 2020, none of the Portfolio Managers listed above held a beneficial interest in any Timothy Plan Funds.

Board Considerations

On September 28, 2020, the Fund’s Board of Trustees held a Special meeting to consider, among its stated business, a new sub-investment adviser for the REIT allocation of the Fund, atand after full deliberation, selected Chilton to serve in that capacity.

Legal counsel to the meeting. The voteBoard reminded the Board that currently there are five factors set forth in the case law and by SEC disclosure requirements as minimum considerations for the approval of a “majorityinvestment sub-advisory agreements, each of which must be covered. Legal counsel then guided the Board through each consideration, including: (1) the nature, extent, and quality of the outstanding shares”services to be provided by the sub- adviser; (2) the investment performance of the Fund and the sub-adviser; (3) the costs of the services to be provided and profits to be realized by the sub-adviser and its affiliates from the relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows; and (5) whether fee levels reflect these economies of scale for the benefit of Fund investors.

During its deliberations, the Board reviewed the qualifications of Chilton and heard a presentation by representatives of UBS PRIME Consultants and TPL relating to Chilton. UBS Prime Consultants is requireda third party consulting firm that provides oversight and detailed reporting of sub-advisers for the Trust and for TPL. Mr. Ally next reported that he had no material negative matters to replacereport. Mr. Ally expressed confidence and praise for the Fundamentalfirm and in the firm’s past service to the Timothy Plan Funds. Mr. Ally then presented the results of his due diligence assessment, reporting that he had not found any matter that would disqualify or otherwise negatively impact his opinion of Chilton as a sub-investment adviser for the Fund.

The Board then received written information relating to the experience, strengths, other clients and past investment limitationsperformance of Chilton and noted with approval the firm’s consistent investment performance, its size and level of expertise, and quality of clientele. The Board noted with further approval that no officer or trustee of the Fund (Proposal 1). The vote of a “majority ofor Trust was affiliated with Chilton, and that no compensation was to be paid to Chilton other than sub-advisory fees under the outstanding shares” meansagreement. Further, the vote ofBoard noted with approval that the lesser of (1) 67% or more ofproposed compensation to be paid to Chilton was almost identical to the shares present or representedcompensation

currently paid to Delaware, and would be paid by proxy atTPL and not the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% ofFund, so there would be no increase in expenses to the Fund’s outstanding shares. Proxies properly executedshareholders. The Board also reviewed the financial condition of Chilton and marked with a negative vote or an abstention will be consideredquestioned both TPL and UBS at length to be present atassure themselves that Chilton was financially capable of undertaking the Meeting for purposesresponsibilities of determiningserving the existenceFund. After reviewing the information and the report of a quorum forTPL and UBS, the transactionBoard agreed that Chilton had sufficient resources to adequately serve the Fund. The Board also reviewed the past performance of business. If the Meeting is called to order but a quorum is not present at the Meeting, the persons named as proxies may vote those proxies that have been receivedChilton with respect to adjournmentChilton clients with investment mandates similar to the Fund and found that performance to be more than adequate. Because Chilton was being engaged as a sub-adviser and its fees would have no effect on overall Fund expenses, costs of services, potential economies of scale and fee levels to achieve economies of scale were all considered moot points.

Consideration of the MeetingSub-Advisory Agreement

The Board then turned its attention to a later date. If a quorum is present at the Meeting but sufficient votes to approve the proposals described herein are not received, the persons named as proxies may propose one or more adjournmentsterms of the Meetingproposed sub-advisory agreement. Under the terms of the proposed sub-advisory agreement with Chilton, Chilton would be responsible for providing day-to-day investment advice and choosing the securities in which the Fund invests relating to the Fund’s REIT allocation. Chilton would report directly to TPL, and TPL would be responsible to report to the Board for any errors or omissions made by Chilton. Chilton would not to exceed 120 daysbe responsible for mistakes or errors of judgment in its management of the investments of the Fund unless those mistakes or errors of judgment resulted from the record date for the meeting, to permit further solicitationgross negligence, willful misfeasance or intentional wrongdoing. The proposed sub-advisory agreement would have an initial term of proxies. Any such adjournment will require thetwo years, and could be renewed annually thereafter by affirmative vote of a majority of the Board of Trustees and a separate concurring majority vote of the Trust’s independent Trustees. The proposed sub-advisory agreement may be terminated by any party at any time, without penalty, upon sixty (60) days written notice. The proposed sub-advisory agreement would become effective immediately upon receipt of shareholder approval. A copy of the proposed sub-advisory agreement with Chilton is included as Exhibit B to this proxy, which is incorporated by reference into this discussion as if fully set forth herein. It is identical in all material respects to the previous agreement.

The Board then discussed the proposed fees payable to Chilton for its services to the Fund. Since those sharesfees would be paid to Chilton by TPL out of the fees it received from the Fund, the Board sought TPL’s opinion concerning the reasonableness of the proposed fee structure. TPL reported to the Board that Chilton was at least as competitive as the other candidates it had interviewed with respect to its proposed fees. TPL further reported that because Chilton’s proposed fees were so reasonable, TPL would be able to maintain its current level of service to the Funds without the need to seek an overall fee increase.

Based on the Board’s review and UBS and TPL’s recommendation, the Board unanimously voted to approve Chilton as sub-adviser to the Fund and to seek shareholder approval of their choice. The Board also unanimously approved an interim agreement under which Chilton could continue to provide services to the Funds for a period of not more that 150 days, pending shareholder approval of the formal agreement. The Board undertook that action in order to assure that the Funds continued to have professional management.

Financial Effect on the Fund

If Chilton becomes the new Sub-Adviser to the Fund, the fees paid by shareholders of the Fund represented atwill remain exactly the Meetingsame. Fund shareholders currently pay total investment advisory fees of 0.60% per annum of the average daily assets of the Fund to TPL. If Chilton becomes the new Sub-Adviser to the Fund, TPL will pay to Chilton, from the fee it receives from the Funds, the fees described in personthe paragraph above.

If the Fund’s shareholders do not approve this Proposal, the Trust will consider other alternatives, including proposing another sub-adviser, having TPL manage the Fund independently, or by proxy. The persons namedclosing the Fund.

Board Recommendation

For all the reasons enumerated above, the Fund’s Board of Trustees, including the independent Trustees, unanimously recommends that you vote “For” Proposal # 1. |

-----------------------------------------------------------------------------------------------------------------------------------------------------------------

| PROPOSAL # 2. | APPROVAL OF A NEW SUB-INVESTMENT ADVISORY AGREEMENT WITH BARROW, HANLEY, MEWHINNEY & STRAUSS, LLC (“BHMS”) ON BEHALF OF FIXED INCOME ALLOCTION OF THE TIMOTHY PLAN DEFENSIVE STRATEGIES FUND |

TPL serves as proxies will vote those proxies received that voted in favorthe investment adviser to the Fund and is responsible for the overall management and supervision of the Fund and its operations. However, the day-to-day selection of securities for the Fund and the provision of a proposalcontinuing and cohesive fund investment strategy is generally handled by one or more sub-advisers (“Sub-Advisers”).

One of TPL’s principal responsibilities as investment adviser is to select and recommend suitable firms to offer day-to-day investment management services to the Fund as sub-advisers. These sub-advisory firms are paid for their services to the particular fund by TPL out of the fees paid to TPL by the applicable fund.

The Fund currently utilizes BHMS as Sub-Adviser to manage the Fixed Income Allocation of its investment portfolio. BHMS has served as a Sub-Adviser to the Fund since the Fund’s inception.

The BHMS sub-advisory agreement was last renewed by the Board on February 14, 2020. Under the terms of the sub-advisory agreement, BHMS manages the day-to-day investment and reinvestment of the fixed income allocation of the Fund’s portfolio securities and continuously reviews, supervises and administers the investment program of the Fund, all under the supervision of TPL and the Trust’s Board. Under the current sub-advisory agreement, BHMS is not liable for any error of judgment or any loss unless the error or loss results from the gross negligence, bad faith or willful malfeasance of BHMS. The current agreement may be terminated without penalty by any party upon 60 days written notice. The proposed sub-advisory agreement with BHMS is identical in favorall material respects to the sub-advisory agreements currently in place for the Fund. Importantly, the fees being charged by BHMS will not change, and the personnel who manage the Fund will stay the same. Most importantly, the Fund’s overall fee structure will remain the same.

At the Board’s quarterly meeting held on August 28, 2020, the Board was informed that BHMS had entered into an agreement with Perpetual U.S. Holding Company Inc. (“Perpetual”) wherein Perpetual would purchase the entire 75.1% ownership interest in BHMS currently held by BrightSphere. Like BrightSphere, Perpetual is a holding company that invests in a wide variety of such an adjournmentfinancial institutions. BHMS informed the Board that the BHMS management team would remain in place after the transaction and that the portfolio management teams currently in pace for the Funds would remain unchanged after the Transaction. BHMS further informed the Board that the Transaction was due to close on November 30, 2020. Assuming the Transaction closes as anticipated, the current sub-advisory agreement would terminate. Accordingly, a new sub-advisory agreement has been approved by the Board and your ratification is being sought.

Fees and Expenses

Fees paid to BHMS under the proposed sub-advisory agreement will vote those proxies received that voted againstbe identical to the proposal against any such adjournment.fees currently paid by the Fund.

Abstentions and “broker non-voters” are countedAs compensation for purposes of determining whether a quorum is present but do not represent votes castits services with respect to the proposal. “Broker non-votes”Fund, BHMS receives from TPL an annual fee at a rate equal to 0.15% of the average net assets in the Debt Instrument Sleeve of the Fund.

The fees described above shall be computed daily based upon the net asset value of the Funds, in the aggregate, as determined by a valuation made in accordance with the Trust’s procedures for calculating Fund net asset value as described in the Trust’s currently effective Prospectus and/or Statement of Additional Information.

Assuming that each Fund’s shareholders approve the engagement of BHMS, the sub-advisory agreement will have an initial term of approximately two years. The compensation to be paid to BHMS will be paid to BHMS from the fees received by TPL and will be identical to the previous agreements. Fees to Fund shareholders will not increase.

A copy of the proposed Sub-Advisory Agreement is attached to this proxy as Exhibit C.

Information About Barrow, Hanley, Mewhinney & Strauss

Barrow, Hanley, Mewhinney and Strauss LLC (“BHMS”), 2200 Ross Avenue, 31st Floor, Dallas, TX 75201, currently serves as Sub-Adviser to the Fixed Income and High Yield Bond Funds. BHMS also serves as fixed income manager to the Defensive Strategies Fund and the Growth and Income Fund. BHMS was founded in 1979 as a registered investment advisor, and has provided investment advisory services to institutional and individual investors since that time. BrightSphere Investment Group (“BrightSphere”), a publicly-held company traded on the New York Stock Exchange, currently owns 75.1% of the issued and outstanding ownership interests in BHMS. The other 24.9% of the issued and outstanding ownership interests in BHMS are sharesowned by BHMS employees.

The following persons serve in the capacities indicated below:

James P Barrow, President of BHMS and founding Director

Joseph R. Nixon, Executive Director and Member of the Board of Managers

Cory L. Martin, Executive Director and Member of the Board of Managers

Patricia B. Andrews, Chief Compliance Officer/Chief Risk Officer, and Managing Director

Portfolio Managers: The current portfolio managers for each Fund are described below. After the Transaction, the portfolio management teams will remain exactly the same.

BHMS employs a team management concept. Team members are assigned specific sector responsibilities, but enjoy equal responsibilities in the investment process. The members have equal say in the actual management. The members of the team are Mark C. Luchsinger, Scott McDonald, Deborah A. Petruzzelli, Erik A. Olson and Rahul Bapna.

Mr. J. Scott McDonald, CFA, joined BHMS in 1995. He currently serves as the lead portfolio manager for BHMS’ Long Duration strategies, specializing in corporate and government bonds. He is also a generalist in investment grade fixed income credit research.

Mr. Mark C. Luchsinger, CFA, joined BHMS in 1997. He currently serves as a portfolio manager/analyst, specializing in investment grade and high yield corporate bond strategies and is the lead portfolio manager for the BHMS Core and Core Plus strategies.

Ms. Deborah A. Petruzzelli joined BHMS in 2003. She serves as structured securities portfolio manager for mortgage- backed, asset-backed, and commercial mortgage-backed securities.

Mr. Erik A. Olson joined BHMS in 2001. He serves as a portfolio manager/analyst on high yield strategies and as a senior analyst in credit research.

Mr. Rahul Bapna, CFA, joined BHMS in 2012. He serves as a portfolio manager/analyst on intermediate and short maturity strategies and as a senior analyst in credit research.

Additional Information about BHMS

The following table presents information relating to the persons responsible for managing Fund assets, the number and types of other accounts managed by such persons, and how such persons are compensated for managing such accounts. The information is current as of September 30, 2020.

| Number of Other Accounts Managed And Assets by Account Type | Number of Accounts and Assets for Which Advisory Fee is Performance- Based | |||||||||||||

Portfolio Manager | Registered Investment Companies ($mils) | Other Pooled Investment Vehicles ($mils) | Other Accounts ($mils) | Registered Investment Companies ($mils) | Other Pooled Investment Vehicles ($mils) | Other Accounts ($mils) | ||||||||

J. Scott McDonald | 2 ($120.0) | 2 ($553.5) | 107 ($11,301.8) | N/A | N/A | 1 ($928.8) | ||||||||

Mark C. Luchsinger | 2 ($120.0) | 4 ($720.8) | 104 ($1,239.6) | N/A | N/A | 1 ($928.8) | ||||||||

Deborah A. Petruzzelli | 2 ($120.0) | 2 ($535.5) | 72 ($4,561.4) | N/A | N/A | N/A | ||||||||

Erik A. Olson | 2 ($120.0) | 4 ($720.8) | 104 ($11,239.6) | N/A | N/A | 1 ($928.8) | ||||||||

Rahul Bapna | 2 ($120.0) | 3 ($615.4) | 104 ($11,239.6) | N/A | N/A | 1 ($928.8) | ||||||||

In addition to base salary, all portfolio managers and analysts share in a bonus pool that is distributed semi-annually. The amount of bonus compensation is based on quantitative and qualitative factors. Analysts and portfolio managers are rated on their value added to the team-oriented investment process. Compensation is not tied to a published or private benchmark. It is important to understand that contributions to the overall investment process may include not recommending securities in an analyst’s sector if there are no compelling opportunities among the industries covered by that analyst.

Also, all of the fixed income portfolio managers are managing directors of the firm and receive, on a quarterly basis, a share of the firm’s profits, which are, to a great extent, related to the performance of the entire investment team. In addition, many of our key employees, including all portfolio managers and the majority of our analysts, have economic ownership in BHMS through a limited partnership that owns a 24.9% equity interest in BHMS LLC.

The compensation of portfolio managers is not directly tied to growth in assets and portfolio managers are not compensated for bringing in new business. Of course, growth in assets from the appreciation of existing assets and/or growth in new assets will increase revenues and profit. The consistent, long-term growth in assets at any investment firm is to a great extent, dependent upon the success of the portfolio management team. The compensation of the portfolio management team at BHMS will increase over time, if and when assets continue to grow.

As of September 30, 2020, none of the Portfolio Managers listed above held a beneficial interest in any Timothy Plan Funds.

Board Considerations

At the Board’s quarterly meeting held on August 28, 2020, the Board was informed that BHMS had entered into an agreement with Perpetual U.S. Holding Company Inc. (“Perpetual”) wherein Perpetual would purchase the entire 75.1% ownership interest in BHMS currently held by BrightSphere. Like BrightSphere, Perpetual is a brokerholding company that invests in a wide variety of financial institutions. BHMS informed the Board that the BHMS management team would remain in place after the transaction and that the portfolio management teams currently in pace for the Funds would remain unchanged after the Transaction. BHMS further informed the Board that the Transaction was due to close on November 30, 2020.

Legal counsel to the Board then informed the Board that upon the closing of the Transaction, the sub-advisory agreements currently in effect for the Funds would automatically terminate, because under federal law, the Transaction is likely considered an “assignment” of the sub-advisory agreements, and assignments are prohibited. As a result, the Board would need to consider whether to re-engage BHMS or nomineeseek the services of a new sub-adviser. TPL strongly recommended that the Board re-engage BHMS for whom an executed proxyall the Fund.

During its deliberations, the Board reviewed the qualifications of BHMS and heard a presentation by representatives of UBS PRIME Consultants and TPL relating to BHMS. UBS Prime Consultants is a third party consulting firm that provides oversight and detailed reporting of sub-advisers for the Trust and for TPL. Mr. Ally next reported that he had no material negative matters to report. Mr. Ally expressed confidence and praise for the firm and the firm’s past service to the Timothy Plan Funds. Mr. Ally then presented the results of his due diligence assessment, reporting that he had not found any matter that would disqualify or otherwise negatively impact his opinion of BHMS as a sub-investment adviser for the Fund.

The Board then formally considered the re-engagement of BHMS, and after full consideration, approved the re-engagement of BHMS for all three Funds and directed Trust management to call a shareholders meeting of the Funds to seek shareholder approval of the decision.

In coming to its conclusions, the Board received written information relating to the experience, strengths, other clients and past investment performance of BHMS and noted with approval the firm’s consistent investment performance on behalf of the Fund, its size and level of expertise, and quality of clientele. The Board noted with further approval that no officer or trustee of the Fund or Trust was affiliated with BHMS, and that no compensation was to be paid to BHMS other than sub-advisory fees under the agreement, and that the fees payable to BHMS would be paid by TPL out of the fees received by TPL from each Fund. Further, the Trust, but areBoard noted with approval that compensation paid to TPL for each Fund was identical to the compensation currently paid to TPL, so there would be no increase in expenses to the Fund’s shareholders. The Board also reviewed the financial condition of BHMS and questioned both TPL and UBS at length to assure themselves that BHMS was financially capable of undertaking the responsibilities of serving the Fund. After reviewing the information and the report of TPL and UBS, the Board agreed that BHMS had sufficient resources to adequately serve each Fund.

Consideration of the Sub-Advisory Agreement

The Board then turned its attention to the terms of the proposed sub-advisory agreement. Under the terms of the proposed sub-advisory agreement with BHMS, BHMS would be responsible for providing day-to-day investment advice and choosing the fixed income securities in which the Funds invest relating to the Fund’s fixed income allocation. BHMS would report directly to TPL, and TPL would be responsible to report to the Board for any errors or omissions made by BHMS. BHMS would not votedbe responsible for mistakes or errors of judgment in its management of the investments of the Fund unless those mistakes or errors of judgment resulted from gross negligence, willful misfeasance or intentional wrongdoing. The proposed sub-advisory agreement would have an initial term of two years, and could be renewed annually thereafter by affirmative vote of a majority of the Board of Trustees and a separate concurring majority vote of the Trust’s independent Trustees. The proposed sub-advisory agreement may be terminated by any party at any time, without penalty, upon sixty (60) days written notice. The proposed sub-advisory agreement would become effective immediately upon receipt of shareholder approval. A copy of the proposed sub-advisory agreement with BHMS is included as Exhibit B to one or more proposals because instructions have not beenthis proxy, which is incorporated by reference into this discussion as if fully set forth herein. It is identical in all material respects to the previous agreements.

The Board then discussed the proposed fees payable to BHMS for its services to the Fund. Since those fees would be paid to BHMS by TPL out of the fees it received from the beneficial owners or persons entitled to vote andFund, the broker or nominee does not have discretionary voting power. NotwithstandingBoard sought TPL’s opinion concerning the foregoing, “broker non-votes” will be excluded from the denominatorreasonableness of the calculationproposed fee structure. TPL reported to the Board that BHMS was at least as competitive as the other candidates it had interviewed with respect to its proposed fees. TPL further reported that because BHMS’s proposed fees were so reasonable, TPL would be able to maintain its current level of service to the Funds without the need to seek an overall fee increase.

Based on the Board’s review and UBS and TPL’s recommendation, the Board, with the Independent Trustees separately concurring, unanimously voted to approve BHMS as sub-adviser to the Fund and to seek shareholder approval of their choice. The Board, with the Independent Trustees separately concurring, also unanimously approved an interim agreement, effective December 1, 2020, under which BHMS could continue to provide services to the Funds for a period of not more that 150 days, pending shareholder approval of the number of votes requiredformal agreement. The Board undertook that action in order to approve any proposalassure that the Funds continued to adjournhave professional management in the Meeting. Accordingly, abstentions and “broker non-votes” will effectively be a vote against the proposal, for which the required vote is a percentageevent that shareholder approval of the outstanding voting shares andSub-Advisory Agreement had not been obtained prior to November 30, 2020.

Financial Effect on the Fund

If BHMS becomes the new Sub-Adviser to the Funds, the fees paid by shareholders of the Fund will have no effect on aremain exactly the same.

If the Fund’s shareholders do not approve this Proposal, the Trust will consider other alternatives, including proposing another sub-adviser, having TPL manage the Fund independently, or closing the Funds.

Board Recommendation

For all the reasons enumerated above, the Board of Trustees, including the independent Trustees, unanimously recommends that you vote for adjournment.“For” Proposal # 2.

OTHER INFORMATION

ADDITIONAL INFORMATION ON THE OPERATION OF THE TRUST

Principal UnderwriterUNDERWRITER

Timothy Partners, Ltd. (“TPL”) 1055 Maitland Center Commons, Maitland, FL 32751, in addition to serving as investment adviser to the Fund, also serves as principal underwriter to the Trust’s shares. TPL is a broker/dealer registered as such with the Securities and Exchange Commission and is a member in good standing of the Financial Industry Regulatory Administration (“FINRA”).

TPL is not directly compensated by the Trust for its distribution services. However, TPL generally retains dealer concessions on sales of Class A Fund shares as set forth in the Trust’s prospectus and may retain some or all of the fees paid by the Fund pursuant to 12b-1 Plans of Distribution. With respect to Class A shares, TPL may pay some or all of the dealer concession to selling brokers and dealers from time to time, at its discretion. A broker or dealer who receives more than 90% of a selling commission may be considered an “underwriter” under federal law. With respect to both Class A and Class C shares, TPL may pay some or all of the collected 12b-1 fees to selling brokers and dealers from time to time, at its discretion

Administrator, Transfer Agent and Fund AccountingADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTING

Gemini Fund Services, LLC, 80 Arkay Drive,4221 N. 203rd Street, Suite 110, Hauppauge, NY 11788,11, Elkhorn, NE 68022-3474, provides administrative, transfer agent, administrative, and accounting services to the Fund pursuant to a written agreement with the Trust.

Independent Registered Public Accounting Firm

The Audit Committee and the Board of Trustees have selected Cohen Fund Audit Services, 1350 Euclid Avenue, Suite 800, Cleveland, OH 44115 (“Cohen”), to serve as the Trust’s independent registered public accounting firm for the fiscal year ending September 30, 2015. Representatives of Cohen are not expected to be present at the Meeting although they will have an opportunity to attend and to make a statement, if they desire to do so. If representatives of Cohen are present at the Meeting, they will be available to respond to appropriate questions from shareholders.

| ||

| ||

| ||

| ||

17

| ||

|

Annual and Semi-Annual Reports

The Trust will furnish, without charge, a copy of its most recent annual report and most recent semi-annual report succeeding such annual report, if any, upon request. To request the annual or semi-annual report, please call us toll free at 800-846-7526, or write to the Trust at 1055 Maitland Center Commons, Maitland, FL 32751. The Fund’s most recent annual and semi-annual reports are available for download at www.timothyplan.com.

Shareholder ProposalsPROPOSALS OF SHAREHOLDERS

As a Delaware business trust,Business Trust, the Trust does not intend to, and is not required to hold annual shareholder meetings, but will hold special meetings as required or deemed desirable. Since the Trust does not hold regular meetings of shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rulesanticipated date of the Securities and Exchange Commission,next shareholders meeting cannot be provided. Any shareholder proposalsproposal that may under certain conditions,properly be included in the Trust’s proxy statement and proxysolicitation material for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materialsspecial shareholder meeting must be received by the Trust withinno later than four months prior to the date when proxy statements are mailed to shareholders.

OTHER MATTERS TO COME BEFORE THE MEETING

The Board is not aware of any matters that will be presented for action at the meeting other than the matters set forth herein. Should any other matters requiring a reasonable time beforevote of shareholders arise, the solicitation is made. proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters in accordance with their best judgment in the interest of the Trust.

FINANCIAL STATEMENTS

The fact thatfinancial statements for each Fund and the Trust receives a shareholder proposal in a timely manner does not insure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Funds are not required as long as there is no particular requirement under the 1940 Act or the Declaration of Trust, which must be metincorporated herein by convening such a shareholder meeting. Any shareholder proposal should be sent to Joseph Boatwright, Secretary of the Trust, 1055 Maitland Center Commons, Maitland, FL 32751.

Shareholder Communications with Trustees

Shareholders who wish to communicate with the Board or individual Trustees should writereference to the Board orTrust’s unaudited semi-annual financial report, dated March 31, 2019, and the particular Trustee in care of the Fund, at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board or the individual Trustee. Shareholders also have an opportunity to communicate with the Board at shareholder meetings. The Trust does not have a policy requiring Trustees to attend shareholder meetings.Trust’s audited annual financial report, dated September 30, 2019.

Proxy Delivery